Offshore Company Formation : A Comprehensive Overview for Business Owners

Offshore Company Formation : A Comprehensive Overview for Business Owners

Blog Article

Strategies for Cost-Effective Offshore Company Formation

When considering offshore company development, the mission for cost-effectiveness comes to be a vital concern for companies looking for to expand their procedures worldwide. In a landscape where financial prudence preponderates, the approaches utilized in structuring offshore entities can make all the distinction in achieving monetary performance and operational success. From browsing the intricacies of territory selection to implementing tax-efficient structures, the trip towards developing an offshore existence is swarming with possibilities and challenges. By exploring nuanced techniques that blend lawful conformity, monetary optimization, and technical improvements, companies can embark on a path in the direction of offshore business formation that is both financially prudent and purposefully noise.

Picking the Right Territory

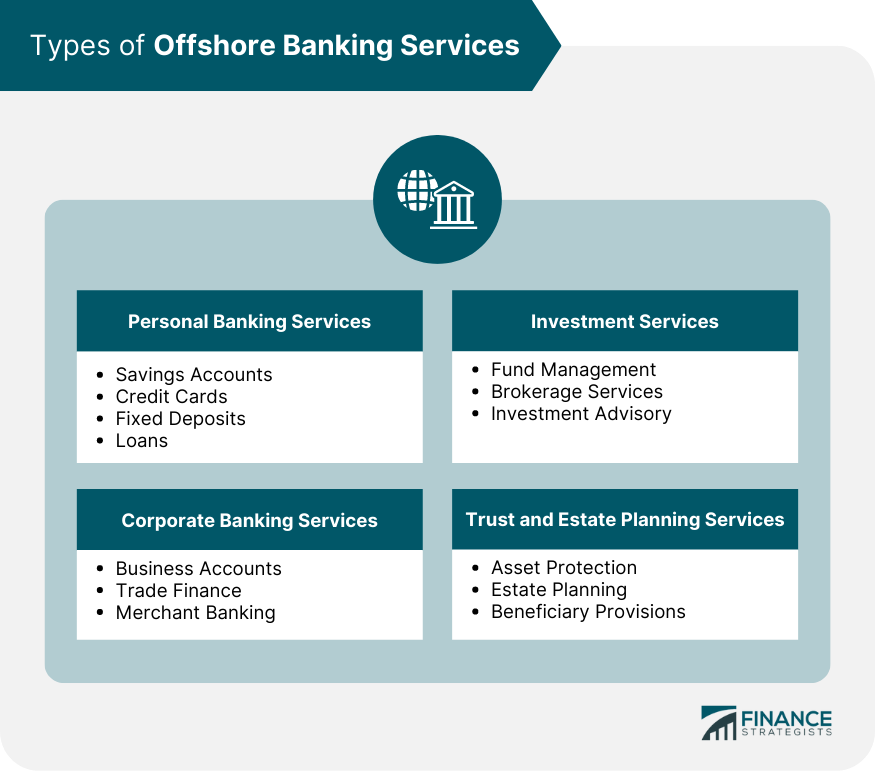

When establishing an overseas business, choosing the ideal jurisdiction is a vital decision that can dramatically affect the success and cost-effectiveness of the formation procedure. The jurisdiction picked will certainly identify the governing structure within which the company runs, affecting taxes, reporting demands, privacy laws, and general service adaptability.

When picking a jurisdiction for your offshore business, a number of elements have to be considered to make sure the decision lines up with your critical goals. One critical aspect is the tax obligation program of the territory, as it can have a substantial effect on the firm's profitability. Furthermore, the degree of governing conformity needed, the financial and political stability of the jurisdiction, and the simplicity of operating needs to all be evaluated.

In addition, the credibility of the jurisdiction in the international organization area is important, as it can affect the understanding of your business by customers, partners, and banks - offshore company formation. By thoroughly examining these elements and looking for professional advice, you can pick the best jurisdiction for your offshore firm that optimizes cost-effectiveness and sustains your organization objectives

Structuring Your Business Efficiently

To guarantee optimal performance in structuring your overseas company, precise attention needs to be offered to the organizational structure. The initial step is to define the company's possession framework plainly. This includes establishing the directors, officers, and shareholders, along with their responsibilities and duties. By developing a clear ownership structure, you can ensure smooth decision-making procedures and clear lines of authority within the business.

Next, it is necessary to think about the tax obligation ramifications of the selected framework. Various jurisdictions use varying tax benefits and rewards for offshore firms. By meticulously analyzing the tax obligation legislations and guidelines of the selected territory, you can optimize your company's tax performance and lessen unneeded costs.

Additionally, maintaining appropriate documentation and documents is essential for the effective structuring of your overseas company. By maintaining current and precise documents of economic deals, corporate choices, and compliance documents, you can ensure transparency and responsibility within the company. This not just helps with smooth operations however likewise helps in showing compliance with regulative needs.

Leveraging Technology for Financial Savings

Reliable structuring of your overseas firm not only pivots on careful interest to business structures but also on leveraging modern technology for cost savings. In today's digital use this link age, technology plays a crucial duty in improving procedures, reducing costs, and enhancing efficiency. One method to take advantage of technology for financial savings in overseas firm formation is by utilizing cloud-based solutions for information storage space and collaboration. Cloud innovation gets rid of the demand for expensive physical facilities, reduces upkeep expenses, and provides flexibility for remote job. Additionally, automation tools such as electronic signature platforms, accounting software program, and task monitoring systems can dramatically cut down on manual work prices and boost overall productivity. Accepting on-line interaction tools like video conferencing and messaging applications can also lead to cost financial savings by decreasing the need for travel expenditures. By integrating modern technology strategically into your offshore business formation process, you can accomplish substantial cost savings while boosting operational performance.

Lessening Tax Obligation Responsibilities

Making use of critical tax obligation planning techniques can successfully minimize the financial concern of tax responsibilities for overseas business. One of the most typical techniques for reducing tax responsibilities is via revenue shifting. More about the author By dispersing revenues to entities in low-tax jurisdictions, overseas business can legally lower their overall tax obligation responsibilities. Additionally, capitalizing on tax obligation rewards and exemptions supplied by the jurisdiction where the offshore business is registered can lead to significant savings.

Another technique to reducing tax obligation liabilities is by structuring the overseas business in a tax-efficient manner - offshore company formation. This includes thoroughly making the ownership and functional framework to optimize tax advantages. Establishing up a holding company in a territory with favorable tax obligation laws can aid combine profits and reduce tax exposure.

Additionally, staying upgraded on worldwide tax policies and conformity needs is crucial for minimizing tax obligation responsibilities. By making sure stringent adherence to tax obligation legislations and laws, offshore business can avoid costly penalties and tax obligation conflicts. Looking for expert suggestions from tax obligation professionals or legal experts concentrated on international tax obligation issues can also provide valuable insights right into efficient tax obligation preparation approaches.

Ensuring Compliance and Risk Mitigation

Executing robust compliance steps is necessary for offshore business to mitigate threats and maintain governing adherence. To make sure compliance and minimize threats, overseas companies ought to carry out comprehensive due diligence on clients and organization partners to prevent participation in immoral tasks.

Additionally, remaining abreast of altering policies and legal needs is vital for offshore firms to adjust their compliance practices accordingly. Engaging lawful experts or compliance specialists can supply useful assistance on browsing complex regulatory landscapes and making certain adherence to international requirements. By focusing on compliance and risk reduction, overseas business can enhance openness, build trust fund with stakeholders, and safeguard their procedures from possible legal effects.

Verdict

Utilizing critical tax preparation strategies can efficiently lower the economic concern of tax obligations for offshore firms. By dispersing profits to entities in low-tax jurisdictions, overseas firms can lawfully decrease their overall tax obligation obligations. In addition, taking advantage of tax obligation incentives and exemptions supplied by the territory where the overseas company is registered can result in significant savings.

By guaranteeing rigorous adherence to tax laws and policies, overseas firms can avoid costly fines and tax disagreements.In conclusion, affordable offshore business development requires cautious factor to consider of territory, efficient structuring, innovation utilization, tax obligation minimization, and conformity.

Report this page